The price of gas is high, but we’ve seen worse.

Oil markets are to blame, and there’s a logical explanation.

No, high gas prices don’t mean we’re destined for a downturn.

Putting gas prices in context

Pain at the pump is making headlines these days, with gas station displays showing some of the highest numbers in history. But how bad is it really? In short, we’ve seen worse.

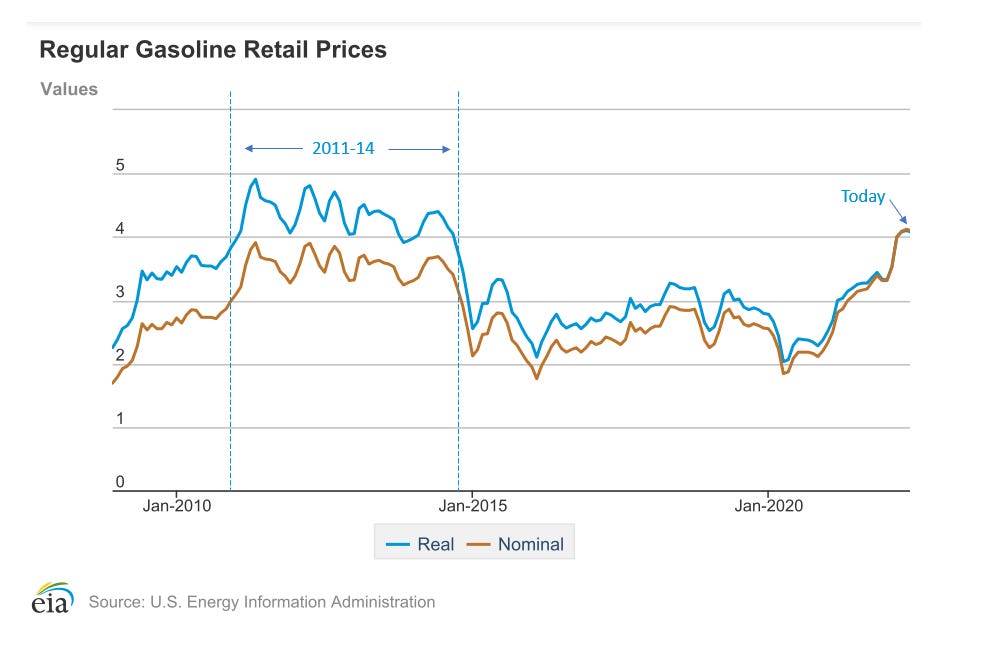

The blue line in the chart below shows the past price of gasoline in the equivalent of today’s dollars:

Why use the equivalent of today’s dollars? Because comparing to the past requires context. Prices tend to go up over time, which is known as inflation. Since some inflation is expected, prices being higher now than they’ve been in the past isn’t necessarily notable. Coca-Cola doesn’t cost a nickel anymore—how notable is that?

Converting values to the equivalent of today’s dollars accounts for inflation and puts past prices in real context for comparing to now. In doing so with gas, we see that people actually faced higher costs at the pump less than a decade ago.

As the blue line in the graph above shows, the cost per gallon from 2011-14 was well over the equivalent of 4 dollars today. It nearly hit the 5-dollar mark at several points. Now that hurt. But people didn’t storm the streets with pitchforks and torches, so there’s not much talk of it today.

Nonetheless, the price of gas today is higher as of late and that does sting. So, what’s causing the pain?

Oil markets are to blame—how long will it last?

The single largest component of gas prices is the cost of oil, which makes up a little over half of what we pay at the pump. With higher oil costs making headlines of their own recently, the surge in gas prices makes sense.

But what’s driving the increase in oil costs? Look no further than some good old-fashioned supply and demand.

Oil supply was cut two years ago to account for the effects of pandemic shutdowns. Then as restrictions eased and people began moving around again, demand spiked. Troubles from a broken global supply chain made it difficult for supply to match renewed demand, sending prices on an upward climb.

And just when it seemed the market might’ve been catching up and leveling off, Russia invaded Ukraine. As the third largest oil producer in the world, Russia plays a key role in supply for certain regions. The fallout from sanctions and other disruptions have created more uncertainty in the global market, sending costs to new heights.

One of the hottest questions today is, how long will these prices last? It’s hard to know for sure. Oil prices depend on a variety of factors and are notoriously hard to predict. But what we can say is that for as long as oil is expensive, it’s likely that gas will be too.

So, do high gas prices mean we’re destined for a downturn?

The current surge in gas prices has people asking whether we’re hurtling toward a recession. The short answer is no, not necessarily. Consider the period we discussed earlier from 2011-14, which saw the highest relative gas prices in the last 40 years.

Gas prices during that period exceeded current levels for several years, as shown by the blue line. But the red line shows that the economy continued growing at a steady rate, much like today.

So, while high gas prices hurt, we can see that it takes more than just pain at the pump for a downturn to occur. Put another away, high gas prices don’t mean a recession is imminent.

Why not? Simply put, a recession occurs when the economy shrinks. But our economy is expanding right now, much like it was during the high gas prices of a decade ago. People, businesses, and governments all continue to spend, fueling continued economic growth.

Might conditions for a downturn arise in the future? That depends on a lot of things. Among them is consumer psychology, which can in fact be influenced by things like the cost of gasoline.

But while risk exists, the current data don’t make a strong case that we’re there right now due to gas prices or otherwise (beyond speculation).

We hope to have a clearer picture of economic growth after new numbers come out next week.

Stay tuned, more to come.

The phrase I've heard circulating is that "gas prices take the elevator up, and the stairs down". Knowing that 97% of oil doesn't come from Russia, is the Russian invasion the only reason that gas prices haven't fallen more, or could price gouging also be a possibility?