Does the Fed have the moves to get us back on track?

The Federal Reserve is trying to rein the economy in without ruining it.

The Fed hopes to engineer a “soft-landing” for the economy.

There are two ways to miss, and we’d like to avoid both.

It’s been pulled off in the past, but what does that mean for us now?

What’s the Fed actually trying to achieve?

The Federal Reserve has been in the spotlight since starting its new plan to get the economy back on track a few weeks ago. After two years of pumping up economic activity, it’s now gradually raising interest rates to slow things down.

The goal is to cool off surging prices that’ve caused discomfort and uncertainty as of late. It hopes to do so gently and avoid completely crushing the economic momentum we’ve enjoyed since the dark days of shutdowns.

To succeed, the Fed needs to engineer what’s called a soft-landing.

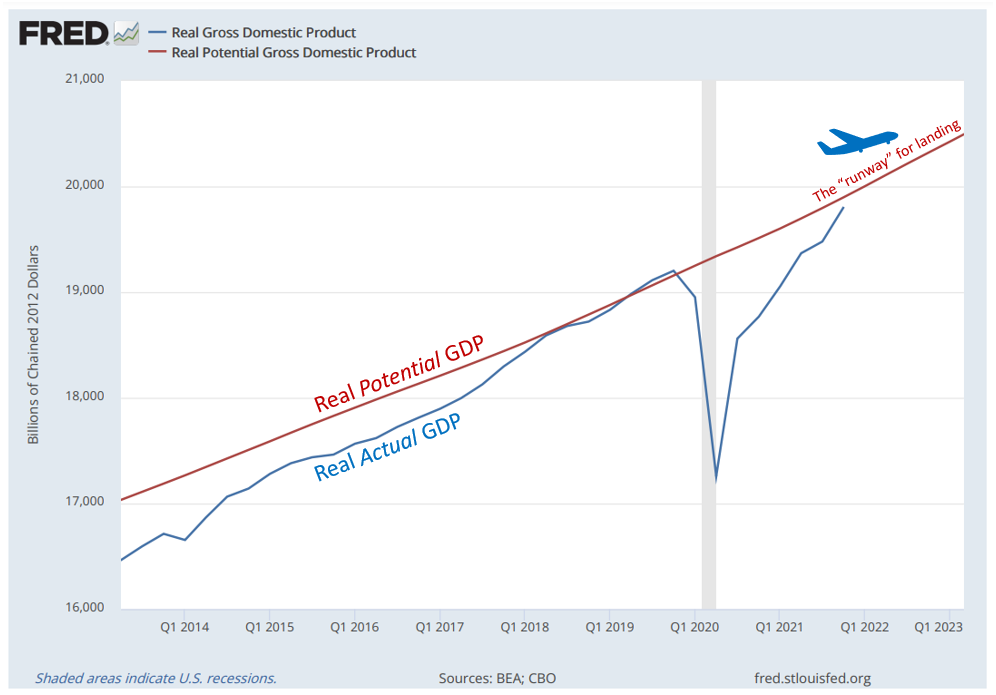

The blue line in the chart above represents the actual level of economic activity in the U.S. If we think of our economy as an airplane, the blue line represents its flight path.

We expect this to go up over time, which is typically good because more activity means people are buying and businesses are hiring. When it goes down, we’re in an economic downturn, which is obviously bad (check out the deep dive from pandemic shutdowns in 2020).

The red line is the potential level of activity we should see when all our resources are used effectively (meaning most workers are employed and most machines are in use). We expect this to grow too, as our productivity tends to go up over time.

So while the blue line shows the actual performance of the economy, the red line is just a theoretical reference point showing how it ideally should be doing.

Back to the airplane: if the blue line tracks our flight path, then the red line extending into the future is the ideal “runway” that the Fed is targeting for its soft-landing.

How could it go wrong? A couple of ways...

In the simplest terms, there are three ways the Fed’s efforts could turn out for us. Only one of them is desirable. Consider the possible cases in the chart below:

In Case 1, our economy blasts right through the runway. This means economic activity would exceed its potential. While it might sound desirable, overactivity tends to put upward pressure on prices. We sometimes use the analogy of an engine being pushed too hard and overheating. But instead of excessive heat, what we see is rampant inflation. Not good.

Case 1 happens if the Fed doesn’t slow the economy down fast enough to prevent prices from surging further. Too little is done to solve the problem, so the problem gets worse.

On the other hand, Case 2 shows our economy coming up short of the runway. This means the economy underperforms its potential. It might not sound so bad but falling short of full potential means resources going unused, which translates to businesses not hiring workers, also known as unemployment. Again, not good.

Case 2 happens if the Fed slows the economy down too quickly and kills off the current momentum. Too much is done to solve the problem, so a new one is created.

With Case 3, we find just the right situation for our Goldilocks character. The economy lands softly on the runway, finding a path with a healthy level of economic activity that doesn’t create any extra pressure on prices or unemployment.

This is what the Fed is shooting for—sustainable growth.

It’s been pulled off before. What does that mean for today?

So which case are we headed for? In short, nobody knows. There are entirely too many factors that can influence the flight path of our economy to know for sure, especially with the uncertainty of today’s world.

But soft-landings have actually been pulled off in the past. Consider one that took place during the mid-1990s:

Notice that it took two full years from the time the Fed started its plan until the soft-landing actually took place. A lesson for us might be to exercise some patience as the current situation plays out.

Nonetheless, today’s circumstances are different: an ongoing global pandemic, a broken global supply chain, and fallout from Russia’s invasion of Ukraine.

While the Fed needs to handle these challenges skillfully, some good fortune would help.

According to Alan Blinder, who served as vice chair of the Fed from 1994-96 during the soft-landing mentioned above, “You’ve got to be both lucky and good.”

Stay tuned, more to come.